Calendar Year Deductible

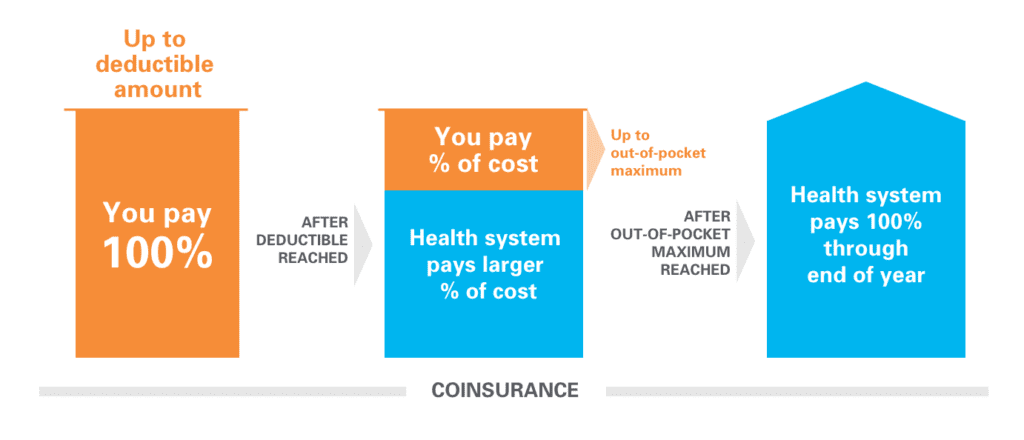

Calendar Year Deductible – Deductibles are generally much larger than copays, but you only have to pay them once a year (unless you’re on Medicare, in which case the deductible applies to each benefit period instead of . Your deductible and coinsurance or copays go toward meeting Elle has $500 left in her annual maximum benefit for future expenses during the calendar year. But in November, she returns to the .

Calendar Year Deductible

Source : www.deltadentalwa.com

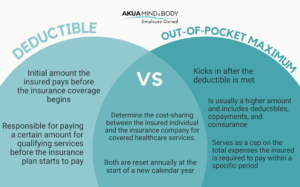

OOP Out of Pocket Maximum calendar year deductible meanings

Source : individuals.healthreformquotes.com

Understanding Your Deductible — The Insurance People

Source : www.insuranceppl.com

OOP Out of Pocket Maximum calendar year deductible meanings

Source : individuals.healthreformquotes.com

What is a Deductible? Guide to Health Insurance Deductibles | eHealth

Source : www.ehealthinsurance.com

Insurance Lingo in the Metal Health World AKUA MIND BODY

Source : akuamindbody.com

Understanding deductibles, copays and coinsurance The University

Source : kansashealthsystembenefits.com

Blue Cross Blue Shield Eligibility Check Calendar Year and

Source : www.tamhealing.com

What Is a Dental Insurance Deductible? | Delta Dental Of Washington

Source : www.deltadentalwa.com

What is a hurricane deductible? Tower Hill Insurance

Source : www.thig.com

Calendar Year Deductible What Is a Dental Insurance Deductible? | Delta Dental Of Washington: First, individuals contributing to their 401 (k) plans have a new limit. In 2023, the cap was set at $22,500. Now, that has increased to $23,000. The IRA contribution limit has also increased, from $6 . The income tax department has published a comprehensive tax calendar on its website at source to employees for salary paid and tax deducted during the Financial Year 2023-24. June 29, 2024 The due .